How is EMI Calculated for Education Loans is one of the major question students should know before applying for educational loan. Education Loan have become an essential tool for students as the cost of higher education continues to rise. Whether you’re planning to enroll in an engineering course or a management program, understanding how your Equated Monthly Installment (EMI) is calculated is crucial for financial planning. In this article, we’ll break down the EMI calculation process for education loans, explain the factors that influence it, and show you how to use an EMI Calculator Education Loan tool to streamline the process.

Table of Contents

1. What Is EMI?

EMI (Equated Monthly Installment) refers to the fixed payment amount a borrower pays every month to repay the principal and interest on an education loan. This method helps in budgeting since the monthly outlay remains constant throughout the repayment tenure.

Benefits of EMI:

- Predictability: Knowing your monthly payment helps in financial planning.

- Simplified Process: EMIs consolidate the total loan repayment into steady, manageable amounts.

- Budget Friendly: Helps students and families plan, even if they’re juggling multiple expenses.

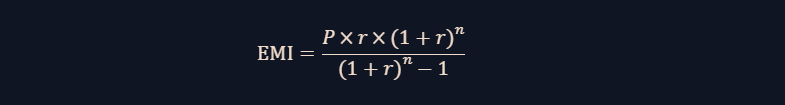

2. The EMI Formula

The standard formula to calculate EMI is:

Where:

- P is the principal loan amount.

- r is the monthly interest rate (annual interest rate divided by 12 and converted to decimal).

- n is the total number of payments (loan tenure in months).

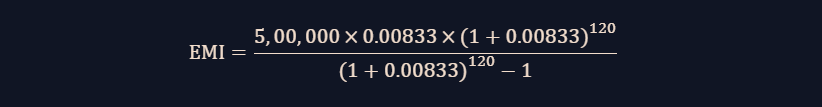

Example Calculation:

Consider an education loan of ₹5,00,000 at an annual interest rate of 10% for a period of 10 years.

- Convert the annual interest rate to monthly:

r = 10/100 X 12 = 0.00833 (approximately) - Total number of monthly installments:

( n = 10 \times 12 = 120 )

Plugging the values into the formula:

This calculation yields an EMI of approximately ₹6,600 per month. (Actual values might differ slightly based on rounding.)

3. Factors Influencing EMI Calculation

Several factors come into play when calculating your education loan EMI:

a. Principal Amount

The initial loan amount—the larger the principal, the higher the EMI.

b. Interest Rate

Both fixed and variable interest rates impact the monthly payment. An increase in the interest rate (or shifting from fixed to variable) raises the EMI.

c. Loan Tenure

A longer tenure spreads out the repayment, thereby reducing the EMI, but increases the total interest paid over the life of the loan.

d. Type of Interest Calculation

Most banks use the reducing balance method, meaning the interest is calculated on the outstanding principal. Partial pre-payments or foreclosures also affect EMI recalculations.

e. Additional Charges

Processing fees, late fees, or insurance may get added to the principal and impact the EMI.

4. How is EMI Calculated for Education Loans Using an EMI Calculator?

Using an online EMI Calculator Education Loan can simplify the entire process. These calculators require you to input:

- Loan amount (principal)

- Annual interest rate

- Loan tenure (years/months)

The calculator automatically applies the EMI formula and gives you:

- The fixed monthly EMI amount

- Total interest payable over the loan period

- Total repayment amount

By experimenting with different values (for instance, adjusting the loan tenure or comparing different interest rates), students can choose options that best suit their financial planning needs. This is particularly useful for students who later aim for stable income sources like jobs in Assam or Assam govt jobs, ensuring that their monthly obligations are manageable.

📌Students in Assam have access to special financial aid programs, reducing their loan burden and making higher education more affordable. Full details Here.

5. Example EMI Calculation Table

Below is a sample table to illustrate how different factors affect your EMI:

| Loan Amount (₹) | Annual Interest Rate (%) | Loan Tenure (Years) | Monthly Interest Rate | Total Number of Payments (n) | Approx. EMI (₹) |

|---|---|---|---|---|---|

| 5,00,000 | 10 | 10 | 0.00833 | 120 | 6,600 |

| 5,00,000 | 10 | 15 | 0.00833 | 180 | 5,200 |

| 5,00,000 | 8 | 10 | 0.00667 | 120 | 5,100 |

Note: EMI values are approximate and may vary based on rounding and bank-specific calculations.

6. Tips to Reduce Your EMI Burden

- Opt for a Longer Loan Tenure: Although this increases the total interest paid, it reduces monthly EMI amounts.

- Look for Lower Interest Rates: Compare various banks and loan schemes using an EMI Calculator Education Loan tool.

- Consider Partial Pre-Payments: Early or periodic pre-payments may reduce the principal and, consequently, the EMI.

- Bundle Fees Wisely: Some banks allow additional fees to be rolled into the loan; however, ensure this doesn’t lead to higher monthly installments.

7. Conclusion

Understanding “How Is EMI Calculated for Education Loans?” is crucial for planning your financial future, especially when you rely on education loans to fund higher education. Given factors like the principal amount, interest rate, and loan tenure, your monthly EMI can be computed using a standard formula or with the aid of an online EMI Calculator Education Loan. This clarity not only prepares you for effective financial planning but also helps manage your monthly outflows as you strive for quality education and secure promising career opportunities, such as jobs in Assam and Assam govt jobs.

By leveraging accurate EMI calculations and exploring various financing options, students can make informed decisions that align with their long-term financial well-being.